Simplify Your Finances: Just How to File Your Online Tax Return in Australia

If approached methodically,Filing your on-line tax obligation return in Australia need not be a challenging job. Understanding the complexities of the tax system and sufficiently preparing your records are important primary steps. Picking a reliable online platform can enhance the procedure, but lots of forget vital information that can affect their total experience. This conversation will certainly discover the required components and approaches for simplifying your funds, ultimately causing a much more effective filing procedure. What are the usual pitfalls to avoid, and exactly how can you guarantee that your return is exact and compliant?

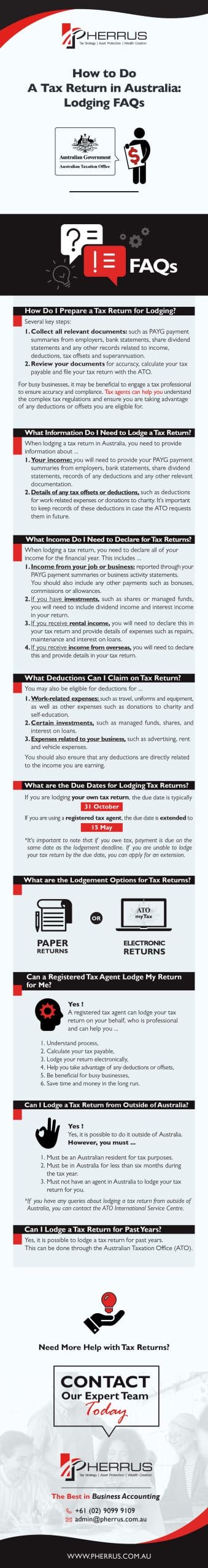

Understanding the Tax Obligation System

To navigate the Australian tax obligation system effectively, it is crucial to realize its essential concepts and framework. The Australian tax obligation system operates a self-assessment basis, indicating taxpayers are responsible for accurately reporting their income and determining their tax commitments. The main tax obligation authority, the Australian Taxation Workplace (ATO), looks after compliance and applies tax obligation legislations.

The tax system consists of various parts, including income tax, products and services tax (GST), and capital gains tax obligation (CGT), amongst others. Specific income tax is dynamic, with rates increasing as earnings increases, while company tax prices vary for small and large organizations. Furthermore, tax obligation offsets and deductions are readily available to reduce taxed income, enabling even more tailored tax obligation obligations based on personal circumstances.

Knowledge tax residency is also crucial, as it determines an individual's tax obligation obligations. Residents are strained on their around the world income, while non-residents are only exhausted on Australian-sourced earnings. Experience with these concepts will certainly empower taxpayers to make enlightened decisions, guaranteeing compliance and potentially optimizing their tax obligation outcomes as they prepare to file their on the internet tax obligation returns.

Readying Your Documents

Gathering the necessary files is a crucial action in preparing to submit your on-line tax return in Australia. Appropriate documents not only simplifies the declaring procedure however likewise makes sure accuracy, lessening the risk of errors that could cause delays or fines.

Begin by accumulating your revenue declarations, such as your PAYG settlement summaries from companies, which detail your incomes and tax obligation withheld. online tax return in Australia. Guarantee you have your company income records and any kind of appropriate invoices if you are self-employed. Furthermore, collect financial institution declarations and paperwork for any rate of interest earned

Following, assemble records of deductible expenditures. This might consist of receipts for occupational expenditures, such as attires, traveling, and devices, along with any educational costs connected to your profession. If you have property, ensure you have paperwork for rental revenue and associated expenses like repairs or residential or commercial property management charges.

Don't neglect to include various other pertinent records, such as your wellness insurance coverage details, superannuation contributions, and any type of investment earnings declarations. By carefully arranging these papers, you set a strong structure for a smooth and effective on the internet tax obligation return procedure.

Picking an Online Platform

After arranging your documents, the next action includes selecting an appropriate online platform for submitting your tax obligation return. online tax return in Australia. In Australia, several reputable platforms are readily available, each offering special attributes tailored to different taxpayer demands

When selecting an on the internet system, consider the customer interface and simplicity of navigating. A simple design can substantially improve your experience, making browse around this site it less complicated to input your details precisely. Additionally, make certain the system is compliant with the Australian Tax Office (ATO) guidelines, as this will assure that your submission satisfies all lawful needs.

Systems providing live chat, phone assistance, or extensive FAQs can give beneficial aid if you encounter difficulties throughout the declaring process. Look for platforms that utilize file encryption and have a strong personal privacy policy.

Lastly, think about the expenses connected with various platforms. While some might use totally free services for standard income tax return, others might bill fees for innovative features or added support. Weigh these variables to choose the platform that lines up best with web your financial situation and filing needs.

Step-by-Step Filing Procedure

The step-by-step filing process for your on the internet tax return in Australia is developed to simplify the entry of your financial info while ensuring conformity with ATO regulations. Started by collecting all essential files, including your income statements, bank declarations, and any invoices for deductions.

As soon as you have your records prepared, log in to your selected online platform and create or access your account. Input your personal information, including your Tax obligation File Number (TFN) and get in touch with information. Following, enter your income information precisely, ensuring to consist of all resources of revenue such as incomes, rental earnings, or investment revenues.

After outlining your earnings, proceed to claim qualified deductions. This might include occupational expenses, charitable contributions, and medical expenditures. Make sure to assess the ATO standards to optimize your claims.

Once all information is gone into, carefully review your return for precision, correcting any type of disparities. After making certain whatever is correct, submit your income tax return online. You will certainly obtain a confirmation of entry; maintain this for your records. Last but not least, check your account for any updates from the ATO concerning your income tax return standing.

Tips for a Smooth Experience

Completing your online tax return can be an uncomplicated process with see here now the right preparation and mindset. To make certain a smooth experience, start by gathering all essential records, such as your earnings declarations, receipts for deductions, and any type of other relevant economic documents. This organization conserves and decreases errors time throughout the filing process.

Following, familiarize on your own with the Australian Taxes Office (ATO) internet site and its on-line solutions. Utilize the ATO's sources, consisting of faqs and overviews, to make clear any type of uncertainties prior to you start. online tax return in Australia. Consider establishing up a MyGov account linked to the ATO for a structured filing experience

In addition, take advantage of the pre-fill functionality provided by the ATO, which instantly occupies a few of your info, lowering the chance of blunders. Guarantee you confirm all entries for precision before entry.

If difficulties arise, do not be reluctant to get in touch with a tax obligation expert or make use of the ATO's assistance services. Adhering to these tips can lead to a successful and convenient on-line tax return experience.

Conclusion

In conclusion, submitting an online tax return in Australia can be streamlined through cautious preparation and option of proper sources. By understanding the tax system, organizing necessary records, and choosing a certified online platform, individuals can browse the declaring process efficiently. Following a structured approach and utilizing readily available assistance makes sure precision and maximizes eligible deductions. Inevitably, these practices contribute to a more reliable tax obligation declaring experience, streamlining economic administration and boosting compliance with tax commitments.